Since September 2013, debt collection has been the top complaint at the CFPB. Among all debt types, medical debt tops the list. When a debt is past due, a collector may report the account to a credit agency. This would appear as an account in collection, often resulting in a credit score drop.

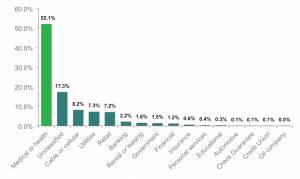

A staggering 52 percent of all collection accounts on credit reports are medical. An estimated 43 million consumers with a credit report at a nationwide consumer reporting agency have one or more medical accounts in collection.

FIGURE 1: SHARE OF COLLECTIONS ON CREDIT REPORTS BY TYPE

Source: Consumer credit reports: A study of medical and non-medical collections

A collections item on a credit report can hurt a credit score severely and inhibit access to insurance, housing or employment. A consumer with a FICO score of 680 could see a score drop of 45-65 points. A score of 780 could drop 105-125 points.

Lack of accountability and standards for collections practices

According to complaints to the CFPB, consumers may not be aware that they owe a medical debt or have time to resolve it, before a collection account appears on their credit report. The absence of any standard of how delinquent a medical debt has to be before it appears on a credit report means this can happen anywhere between 30 – 180 days past the billing date. When collectors substitute active efforts to contact a consumer with a report to credit reporting agencies, they impose a huge cost on consumers.

Confusion from multiple bills, providers, and collectors

Medical billing is complicated and confusing. A single treatment at a hospital can result in multiple bills from multiple providers. For example, after a surgery, a consumer can receive a bill from the surgeon, the anesthesiologist, and the surgery facility. A health insurance policy may cover some providers and some procedures, but not others. And it may cover all or part of a bill. Some consumers may find it difficult to know what they owe, to whom or for what.

This confusion can be amplified when a medical bill goes to collections. Medical providers in turn rely on a series of third-party collectors with only indirect and short term ties to the underlying debt, thereby introducing potential for errors in collections reporting. This can make it challenging for consumers to verify whether they truly owe the debt.

Medical debt is different, but scores haven’t treated it that way

Many consumers who have medical debts in collection, may have the ability and willingness to pay. Of the consumers with only medical collections accounts, 50 percent have otherwise “clean” credit reports. These consumers may have lacked proper notification about the debt from the collector or are in the process of contesting it. Our May 2014 data determined medical debt is not as good a predictor of a consumer’s likelihood of paying a debt as was previously believed.

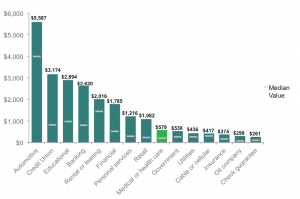

Medical collections accounts are smaller (on average) than many other types of debt. Half of medical debts are under $207. This indicates that consumers may be able to pay them. Some consumers may just be confused about what they owe, believe the debt has already been paid, or that they simply do not owe it. Credit scores that treat medical and non-medical debts the same over-penalize the millions of consumers who have medical debt.

FIGURE 2: AVERAGE AND MEDIAN AMOUNTS OF COLLECTIONS BY TYPE

Source: Consumer credit reports: A study of medical and non-medical collections

More problems for vulnerable consumers

Consumers with many medical bills face even more challenges from the present medical billing and collection system. This may be particularly true for those with medical emergencies or lengthy hospital stays. These consumers may lack the support, time, energy or resources to resolve debt promptly. As consumers have to deal with the illness or emergency, they also must cope with the cost of care and figuring out how much their insurance will cover.

Consumers with language assistance needs (and those assisting them) may have more difficulty recognizing or resolving their bills when dealing with collection agencies. In complaints made to the CFPB in mid-2014, consumers identified as having medical debt were more than twice as likely to claim the “debt was paid” (20.1% to 8.4% for non-medical) and more likely to claim they were “not given enough information” (14.5% to 9% of non-medical).

The current medical debt collection system is not working for consumers

Collectors and medical providers can make medical collections more standardized so that consumer behavior can be more accurately reflected in credit scores.

The IRS is proposing policy that would require non-profit hospitals to wait at least 120 days before engaging a third-party collector and reporting debt to a credit agency. Last year a hospital trade association and a debt collection trade association jointly proposed a similar standard as part of best practices for patient billing, collections, and credit reporting.

More consistent and more accurate reporting may have its biggest impact among consumers who are struggling to understand their medical bills and keep up with health care costs. In addition, it will lead to greater credit predictability and a stronger credit system.