|

Do you think you really know your customers, clients and patients?

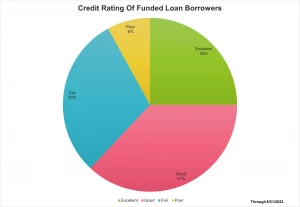

It’s interesting, when we launched Flexxbuy approximately eight years ago, the presumption from business owners and managers was that customer financing was primarily for people with bad credit.

I can understand that sentiment. Most of the solutions, at that time, targeted consumers considered sub-prime. Financing was primarily prevalent at retail businesses and the lure was No Credit Required.

Well, we’ve come a long way in a short time.

Today, it’s widely accepted that many consumers have an appetite for compartmentalizing their transactions by utilizing third party financing.

Tightening pocket books brought on by the largest cost-of-living increases in a generation have just heightened the demand.

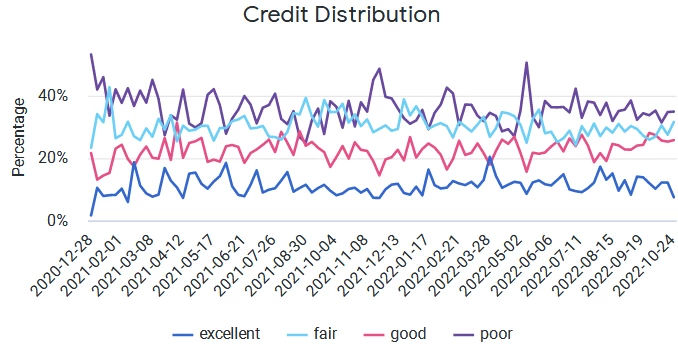

And while NEED still trends demand toward people that consider themselves credit challenged, many factors drive consumers with good and excellent credit toward financing as well.

Flexxbuy’s thirty plus lenders have a broad credit appetite when it comes to approving consumer applications, but there are a number of factors that limit the funded loans that result from applications submitted by individuals with less than prime credit.

- Income is insufficient to approve the application or, the application is approved for an amount that is less than required.

- The application is approved but the terms are considered unacceptable by the applicant.

- Other underwriting factors such as too much debt, current or recent delinquent payment history, unstable employment or housing history fail the lender’s algorithm.

- The terms of approval fall beyond the applicant’s budget or perceived ability to pay.

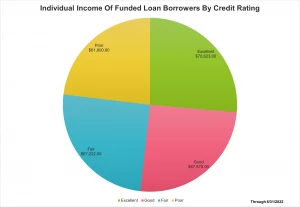

The median individual income for consumers that are ultimately funded through the Flexxbuy platform tell an interesting story.

While credit ratings are a snapshot of past behavior, consumers that are ultimately funded are not too dissimilar from the standpoint of income. .

While lenders will mitigate risks associated with sub-prime credit by adjusting terms and profit margins to offset potential higher defaults, the final decision to lend or not to lend ultimately falls on the individual’s ability to pay back the loan.

In the end, lenders that play in the higher risk zone will factor the probability of a default based on the individual’s credit trend (upwards or downwards), their current fiscal circumstances (debt-to-income ratio), as well as overall financial stability.

The real notable difference among the credit classes is the median loan amount funded.

There are likely a number of factors as to why funded loan amounts trend downward based on credit rating.

- Lenders that focus on higher risk loans are more conservative when it comes to the amount they will allow a consumer to borrow.

- Higher interest rates and shorter terms reduce the affordability for the consumer.

- Individuals with sub-prime credit self-limit their purchasing amount.

- Individuals with past credit challenges are more apprehensive about incurring debt.

The compilation of this data runs through August 2022 so it primarily does not take into account the recent adjustments lenders have made due to the unsteady macroeconomic climate. We have seen lenders tighten their underwriting criteria resulting in more declines across all credit categories but particularly among those on the margins.

The future trends are unpredictable. This may be a precursor to a recession and more difficult times ahead or a bump in the road that will result in a return to normalcy.

Regardless, the demand for customer financing among consumers seeking to stretch their dollars and by businesses striving to broaden their sales channels will continue to grow.

To contact Flexxbuy about their programs, click here